how are rsus taxed in california

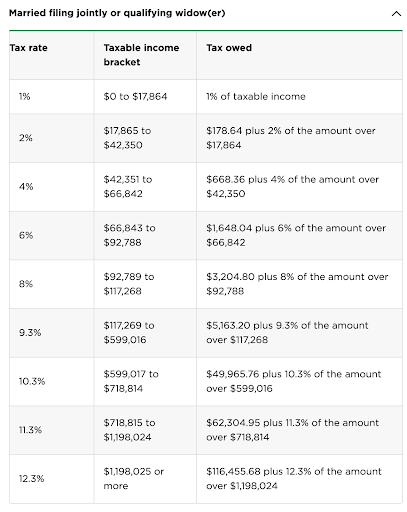

You have to pay taxes as soon as the RSUs vest and the IRS and FTB withholds several taxes using flat rates as defined by law eg 22 federal and 1023 California. RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them.

Taxation Of Restricted Stock Units Rsu Youtube

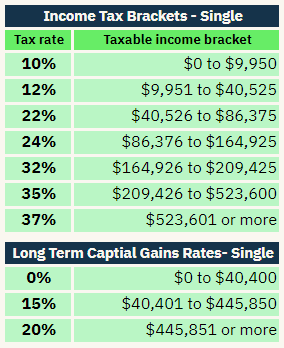

RSUs are taxed as ordinary income thus the rate that the recipient may pay can range from 10 to 37 depending on the recipients household income.

. Most companies will withhold federal income taxes at a flat rate of 22. As the RSUs vest the value is taxed as income. At any rate RSUs are seen as supplemental income.

The value of over 1 million will be taxed at 37. As a California part-year resident non-resident who is now Washington resident it is known that one has to pay California taxes on RSUs if they are vested when heshe worked. Taxpayers will simply translate the figure listed.

When you exercise NSOs you pay California income tax on the spread between your strike price and the current 409A valuation or fair market value. RSUs can trigger capital gains tax but only if the. Your RSU is for a specific number of stock units.

Originally reporting the full value of the RSUs on his. RSUs including so-called double-trigger RSUs are taxed as ordinary income from compensation when they vest. Lets say one year has elapsed and you receive 30 shares of company stock of the 120 RSUs originally granted 25 per year vesting schedule.

The RSUs all vested in 2012 two years after the taxpayer became a California nonresident after moving abroad. If youre a high. Restricted stock units RSUs are becoming a more common type of compensation in California.

Tax at vesting date is. California taxes vested RSUs as income. RSUs are a form of compensation offered by a firm to an employee in the form of company shares.

Allocation Ratio 180 days 365 which is 49 Income taxable in CA 250 shares X. Income in the form of RSUs will typically be listed on the taxpayers W-2 in the Other category Box 14. RSUs are generally subject to a vesting schedule meaning the stock does not.

Contrast that with a 45 all-in tax rate which requires 450 to vest into 10 of. On January 1st 2022 250 shares 14 of your RSUs will vest at a stock price of 10. Also restricted stock units are subject.

RSUs are taxed just like if you received a cash bonus on the vesting date and used that money to buy your companys stock. At vesting date California taxes the portion of the income from. Instead of the employee receiving stock shares.

RSUs in a Divorce. On the day that they vest that number of stock units is multiplied by the value of the stock on that day and that number is considered taxable. Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs.

Your company is required to withhold a fixed 1023 tax for California income tax. How to Report RSUs on Your Tax Return. CA Taxable Income Total RSU income from vest x Allocation Ratio And keep in mind that when your shares vest in 2021 and 2022 a portion will still be taxable in California.

California taxes RSU income in two steps. With an all-in tax rate of 15 you only need to pay 150 for every 10 of RSUs that you vest into. Of shares vesting x.

Secfi How Are Stock Options Taxed In California

Double Taxation Between Ca Ny Nj

You Should Probably Exercise Your Isos In January Graystone Advisor

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Restricted Stock Units In Nqdc Plans Executive Benefit Solutions

Rsus Basics And Taxes San Francisco Ca Comprehensive Financial Planning

Rsus Can Make For A Shocking Tax Bill Without Proper Planning Summitry

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

7 Things You Need To Know About Your Restricted Stock Units Rsus X And Y Advisors Inc

Restricted Stock Units 10 Fast Facts Newsletters Legal News Employee Benefits Insights Foley Lardner Llp

Common Rsu Misconceptions Brooklyn Fi

Restricted Stock Units Jane Financial

Frequently Asked Questions California Residency Rules California Residency Tax Planning October 8 2017

Stock Options Vs Rsus What S The Difference District Capital

Equity Compensation 101 Rsus Restricted Stock Units

Restricted Stock Units A New Checklist In The Equity Compensation Series Fppathfinder

Rsus Basics And Taxes San Francisco Ca Comprehensive Financial Planning

How To Handle State Taxation Of Stock Options After You Move